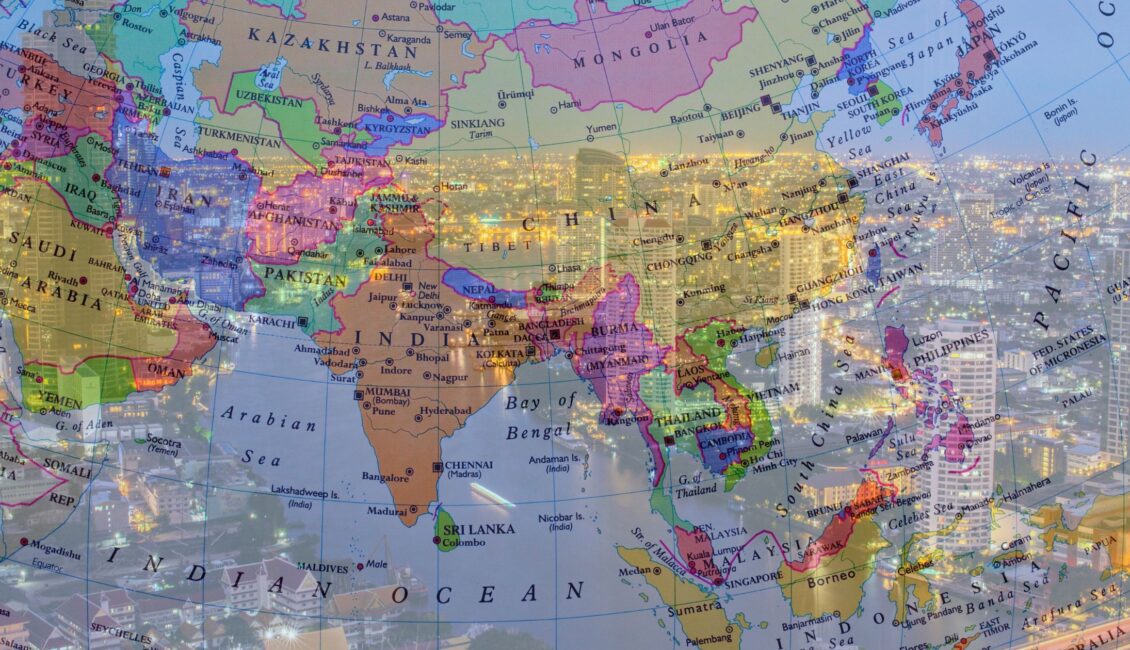

Asia is undeniably the new epicenter of startup innovation, producing a number of unicorns—companies valued at over $1 billion. With China and India alone with more than 300 of these high-value startups, the region is transforming the dynamics of startup growth.

Major tech hubs like Shenzhen, Bangalore, Seoul, and Singapore are not just participants but leaders in fields such as artificial intelligence, fintech, e-commerce, and SaaS. Investors would be wise to turn their attention to the APAC region as it is proving a goldmine of opportunities fueled by rapid growth and increasing global influence.

Southeast Asia’s Startup Boom

Southeast Asia, with over 650 million inhabitants, is rapidly emerging as a key player in the startup scene. The region’s middle class is expected to grow significantly, creating a vast consumer base for new businesses. The digital economy is projected to reach $100 billion by 2025, driven by the proliferation of mobile technology and affordable smartphones. E-commerce, fintech, and health tech startups are gaining traction, with notable success stories like Grab and Gojek leading the way.

Growing Investment Opportunities

Southeast Asia offers relatively low startup valuations, providing an excellent opportunity for investors to support promising tech companies. Additionally, many startups focus on addressing pressing local challenges, such as traffic congestion and limited payment options, presenting unique investment prospects. The increased global attention on the region, particularly in sectors like e-commerce, further emphasizes its potential.

Supportive Environment for Startups

Governments across the APAC region are fostering startup ecosystems through policies that provide tax incentives, funding programs, and regulatory support. The surge in venture capital activity, with over 170 firms now operating in Southeast Asia alone, highlights a growing investment landscape that is ripe for innovation.

Suitability for Different Types of Investors

- Venture Capital Investors (VCs): The APAC startup ecosystem is ideal for VCs seeking high-growth opportunities. With many tech companies still in their early stages, VCs can invest at lower valuations, allowing for potentially high returns as these startups expand. The region’s emphasis on innovation, particularly in sectors like AI and e-commerce, aligns perfectly with VC investment strategies.

- Corporate Venture Capital Investors (CVCs): For CVCs, investing in the APAC region offers access to a dynamic market with tech solutions that can enhance their core business operations. Partnering with local startups allows corporate investors to gain insights into emerging trends and technologies while leveraging the growing consumer base for strategic partnerships.

- Angel Investors: For those looking for a more hands-on investment approach, angel investing is becoming increasingly popular in the APAC region. This route allows investors to connect directly with entrepreneurs and support innovative ideas. Key reasons to consider angel investing include:

- Low Startup Valuations: Investing early can lead to substantial ownership stakes in successful ventures as the ecosystem matures.

- Problem-Solving Startups: Many startups are dedicated to addressing local challenges and providing practical solutions.

- Global Interest: The APAC region is attracting significant attention from global investors, leading to potential acquisition opportunities for startups.

- E-commerce Growth: The rapid growth of e-commerce is creating various investment avenues in emerging online retail ventures.

- Knowledge and Capital Rewards: Investors with industry knowledge can significantly enhance their chances of success.

While regions like China and India often take the spotlight, the broader APAC region—including Southeast Asia—offers great opportunities for tech investors seeking to tap into a growing economy. With its mix of low valuations, diverse startups, and supportive policies, the region is well-positioned for investment growth.

The APAC startup ecosystem is thriving, making it a prime location for venture capitalists and angel investors alike. Now is the perfect time to explore these opportunities and be part of this exciting transformation.